Storm clouds revealed by the Budget will force taxpayers in Birmingham to work an extra 2 years without pay to balance the country’s books

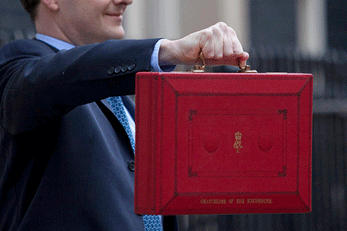

Birmingham accountants James, Stanley & Co. Limited have today launched two free initiatives to prevent local taxpayers and businesses being drowned by the storm clouds identified in the small print of George Osborne’s Budget. Inevitably the likes of the sugar levy, school reforms, lifetime ISAs, business rates exemptions and flood defence spending promises will grab most of the headlines. But the real story today is not about the detailed announcements, which ranged from innovative and genuinely useful to window dressing and spin. It is not even about the prediction that there are storm clouds on the horizon.

The real story today is that the storm clouds aren’t gathering, they are already here. They were here before the Chancellor stood up. And they are still here now he has sat down.

The brutal truth, which the Chancellor confirmed today, is that successive governments have spent over £1.7 trillion more than they have earned. That’s the equivalent of over £58,000 for every single taxpayer, or over £93,000 for every single family in the West Midlands. Putting it another way, someone working full time and earning average national wages would have to work for two years and give every single penny of their wages over to the taxman just to pay for what the country has already spent. And that’s not all, because to pay for new government spending the average Birmingham taxpayer will also need to hand over another 21 weeks’ worth of wages in tax every single year.

Shocking as those numbers are, the good news is that Birmingham can fight back in two key ways. Firstly, by making local business more successful we can generate enough extra jobs, income and wealth to make paying those extra taxes much less painful. And secondly we can make sure that none of us pay an unfair share of those taxes.

Exactly how much we each end up paying is very complicated, and there are a great many traps for the unwary. So we believe that the region’s taxpayers need to take urgent action to protect themselves, their families and their businesses. And to help them, today we are launching a free 2016 Tax Fairness Review service for businesses and individuals to make sure that they don’t pay a single penny more than their fair share in tax.

We are also launching a free “2016 Business Builder” initiative to help Birmingham’s businesses generate the growth and prosperity the country needs in order to make paying all those extra taxes easier and less painful. Using leading-edge software, systems and thinking, it will help local businesses discover new ways to create more jobs, profits and wealth.

Together these initiatives will help to ensure that the region is treated fairly as it pulls it weight.

Andrew

Andrew James is a guest blogger for March

Andrew is a partner at James Stanley & Co Accountants

The Treasury’s full “Budget 2016” document reveals national debt will rise to £1.74 trillion – Table B2, page 137

References

According to the ONS there are 29.7 million taxpayers in the UK. Therefore the £58,000 national debt per taxpayer figure can be calculated by dividing the £1.74 trillion of national debt by the 29.7 million taxpayers. http://www.ons.gov.uk/peoplepopulationandcommunity/birthsdeathsandmarriages/families/bulletins/familiesandhouseholds/2015-11-05

According to the ONS average wages are £497 per week. Therefore for someone earning average wages of £497 a week it will take them 116 weeks to earn the £58,000 national debt per taxpayer. This is, of course, more than 2 years. http://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/earningsandworkinghours/timeseries/kab9

According to the ONS there are 18.7 million families in the UK. Therefore the £93,000 national debt per family figure can be calculated by dividing the £1.74 trillion of national debt by the 18.7 million taxpayers http://www.ons.gov.uk/peoplepopulationandcommunity/birthsdeathsandmarriages/families/bulletins/familiesandhouseholds/2015-11-05

According to The Adam Smith Institute, the average UK taxpayer works until 31 May every year just to pay taxes. They call this “Tax Freedom Day”, and it equates the working 21 weeks a year for the taxman. http://www.adamsmith.org/tax-freedom-day/