The Chancellor has a valid point, one that the Institute of Fiscal Studies (IFS) confirms. Self-employed workers in the UK pay, on average, less tax than employed workers. As the trend increases for workers to move from one model to the other, so the tax base for the country is gradually being eroded. The problem is compounded when the rising average age of our population is causing a huge strain on our welfare state needing more expensive pensions, health and social care.

Our mentoring work involves us with advising many start-up and micro businesses in the West Midlands. Their experience of self-employment varies with the nature of challenges they face. In my own industry, creative and marketing freelancers lose significant income due to the expectation by larger companies that ‘standard industry practice’ allows them to insist on work for free. A study by the Association of Independent professionals (IPSE) for and the Freelancer Club revealed the average cost of this work was £5,400 done in 31 days over the last 2 years*. Some of the enquiries our business receives involves us being asked to ‘pitch’ for business, a process that involves working on a brief from the company concerned which they give to several agencies in the expectation that one of them will win some business. We refuse such ‘opportunities’. Inevitably, participating businesses that ‘lose’ this exercise put their creative talents to work for no reward (and sometimes a sneaking suspicion that their ideas have been fed back to the successful agency). I’ve also seen many ambitious start-up companies with high growth potential cheekily ask agencies to work for free or reduced fees on the basis that “when we are a successful, well known business, this brand will look good in their portfolio”.

This happens in other industries too. My daughter is training to be a classical musician and aspires to play in a professional orchestra. Here in Birmingham the CBSO has a policy of employing their orchestral musicians, however it’s my understanding that this isn’t standard practice for regional orchestras and those based in London who use self-employed freelancers. It’s hardly the ideal financial basis for a stable career, paying your rent or raising a family.

Many freelancers starting a business invest significant amounts of time, effort and resources to acquire new customers. This is often where they require our help and training as it’s outside their area of expertise. Outsourced services help larger businesses be more efficient however it must be inefficient for the economy as a whole for talented, qualified, skilled workers to have insufficient paid work to occupy them full time.There is, sadly, a high failure rate for these types of business and freelancers sometimes are forced to revert back to employment.

And the problem doesn’t end there. Once a freelancer has competed a project they must get paid. Bacs Payment Schemes Limited estimate smaller firms are overdue, on average, £32,000. One third are kept waiting beyond their standard payment terms while more than a quarter receive payment more than 60 days late. The resultant cashflow problems cause sleepless nights, resorting to expensive bank overdrafts and sometimes managers go without their own pay or dividends in order to pay their suppliers and taxes on time. Smaller businesses estimate it costs them £500 a month to chase late payments.

There are some freelancers who set up as self-employed but who work primary, sometimes solely, for one company. Although HMRC IR35 rules are in place to prevent such working models, it’s clear that this is a growing trend used by some employers to reduce their tax obligations and thus increase return on investment for their shareholders. Their world does not necessarily involve the same stresses and challenges as the freelancers who genuinely need find their own work on a regular basis. Here I agree that these people effectively take little entrepreneurial risk and neither are they going to build businesses that will employ others in the future. In this case, asking for higher taxes seems reasonable although this will need to be balanced with the need to provide for their own pension and healthcare.

The public do understand that taxes need to be raised. What many small business owners find hard to accept is the rules being changed to target the little guy. Our impression is that we are a ‘soft’ target. Larger corporates and international companies such as Uber and Deliveroo, who exploit such ‘gig’ economy working models for their own financial gain, are not pursued in the same manner. Large companies who deliberately pay suppliers late could be ‘named and shamed’ and some legal redress could be applied for those that fail to comply with good practice. So, Mr Hammond, please hurry your promised industry reviews of these practices so that ‘fairness’ is seen to be applied.

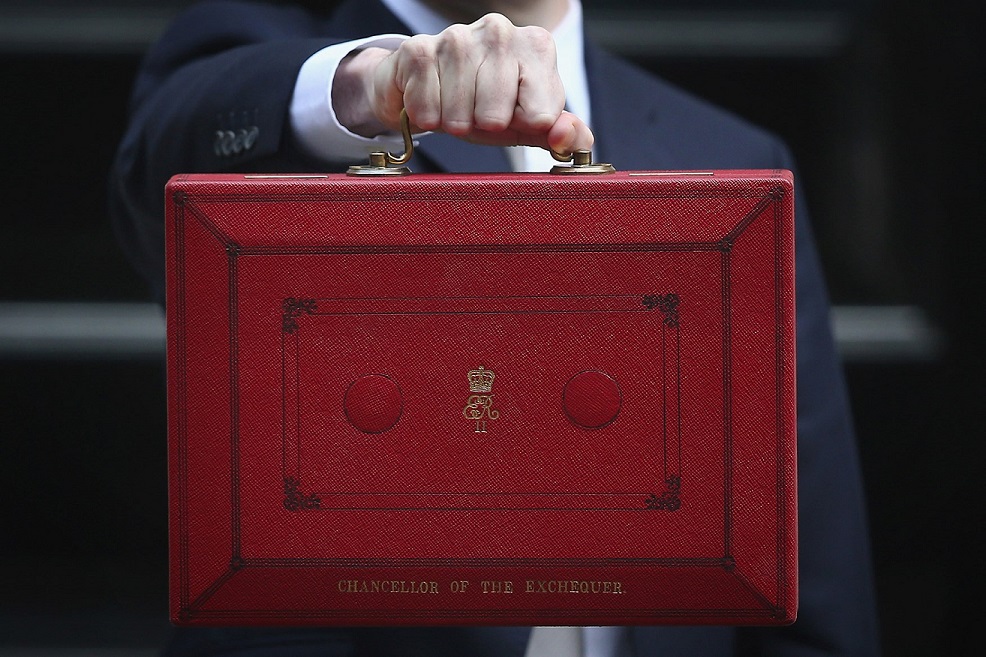

For a light-hearted look at budgets, here’s one of our favourite sketches from the 1980’s ‘Not the 9 o’ clock news’

* IPSE October 2016.

Disclaimer: I’m writing this article from the viewpoint of a small business owner, not a qualified accountant .

Gill